What is a Metro District?

You may have heard this term thrown around by real estate agents, builders or someone hosting an open house. If you are not sure what a metro district is, don’t worry, you are not alone!

A metro district, short for Metropolitan District is a type of Special Taxing District, and you may hear all of these terms used interchangeably.

Metro districts are a way for developers to finance the necessary infrastructure to support a new subdivision. This can include initial construction for the development such as streets, water, storm drainage, gas and electrical to ongoing operations of neighborhood amenities such as parks, playgrounds, pools, etc.

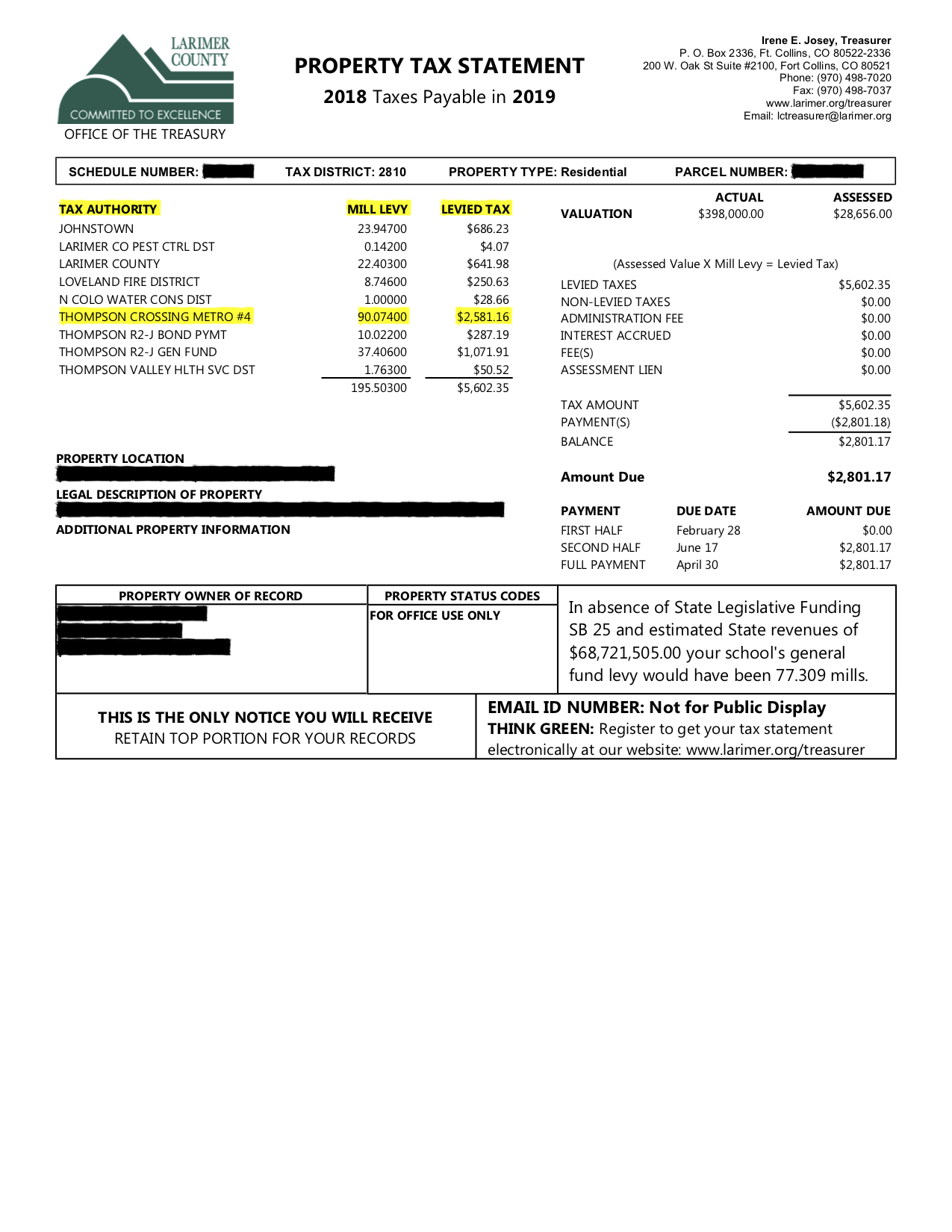

Metro districts have the ability to tax and/or assess fees for the services that it provides. These special taxing districts have an extra mill levy that is added to the annual property tax statement.

Simply put, a property located in a metro district will have an extra mill levy which increases its property taxes compared to a property that is not located within a metro district.

Do all Metro Districts Have The Same Mill Levy ?

No. Because metro districts issue bonds or special assessments to finance the benefit of property owners and the neighborhood each one will have a different mill levy.

How to Calculate Your Property Taxes

The following calculation is used to determine your property tax:

Actual Value x Assessment Rate x Mill Levy / 1000 = Property Tax

For example:

$300,000 Actual Value x 7.20% Assessment Rate = $21,600 Assessed Value

$21,600 Assessed Value x 86.49 mills/1000 = $1,868.18 tax bill

Metro District vs HOA

Do not assume that if a property is located in a metro district that you will not also have additional HOA fees. Some properties located within metro districts also belong to a home owners association (HOA) and may have additional assessment fees, status letter fees, record change fees, etc. For more information on the differences between metro districts and HOAs click here.

So how popular are Metro Districts?

Metro districts are becoming increasingly more common in Northern Colorado and many say they are the way of the future. How popular you might ask?

As of 2017, there were more than 106 metro districts in Larimer County and over 231 in Weld County, according to the State’s Department of Local Affairs (DOLA). These numbers continue to increase each year. There are currently over 20 metro districts in Loveland (eight of which are located in Centerra), almost all of the new subdivisions in Windsor are located in metro districts and in 2018, both Greeley and Fort Collins have approved multiple new metro districts.

Should I Be Scared to Buy a House Located in a Metro District?

Like with any property, we encourage our buyers to look at the overall value of a home and neighborhood when making these decisions. What does it offer in terms of location (is it close to your jobs, schools, social life, etc) as well as amenities. If the cost of living in a metro district means a higher quality of life, buyers may find the cost well worth it.

Many buyers see the extra cost in taxes as no different than paying HOA fees. One argument is that the extra mill levy is potentially tax deductible. Normal HOA fees are not tax deductible.

We Are Here For You

If you have any further questions on metro districts, please do not hesitate to reach out. Consider us a resource for all of your real estate questions and needs!

Sources

For more information concerning what a prospective buyer should know about metro districts, DOLA published Special Districts: A Brief Guide for Prospective Homeowners in 2009. Access the guide here.

This blog post is not to be construed, in any way, as legal advice about special districts, in general, or about any specific district.

Read our Follow-Up Blog Post:

Drama, drama, drama... Metro Districts Follow Up

Shortly after we published our blog post, “What is a Metro (Special Taxing) District & What Prospective Buyers Need To Know,” the Denver Post also published an article regarding Metro Districts, (maybe they got the idea from us 😉) and it has created some drama! There has been a wide spectrum of responses... some people championing the article, adding fuel to their metro districts hate-fire!