“Should I buy now or wait?”

Home prices continue to rise, but even if they don’t, interest rates will!

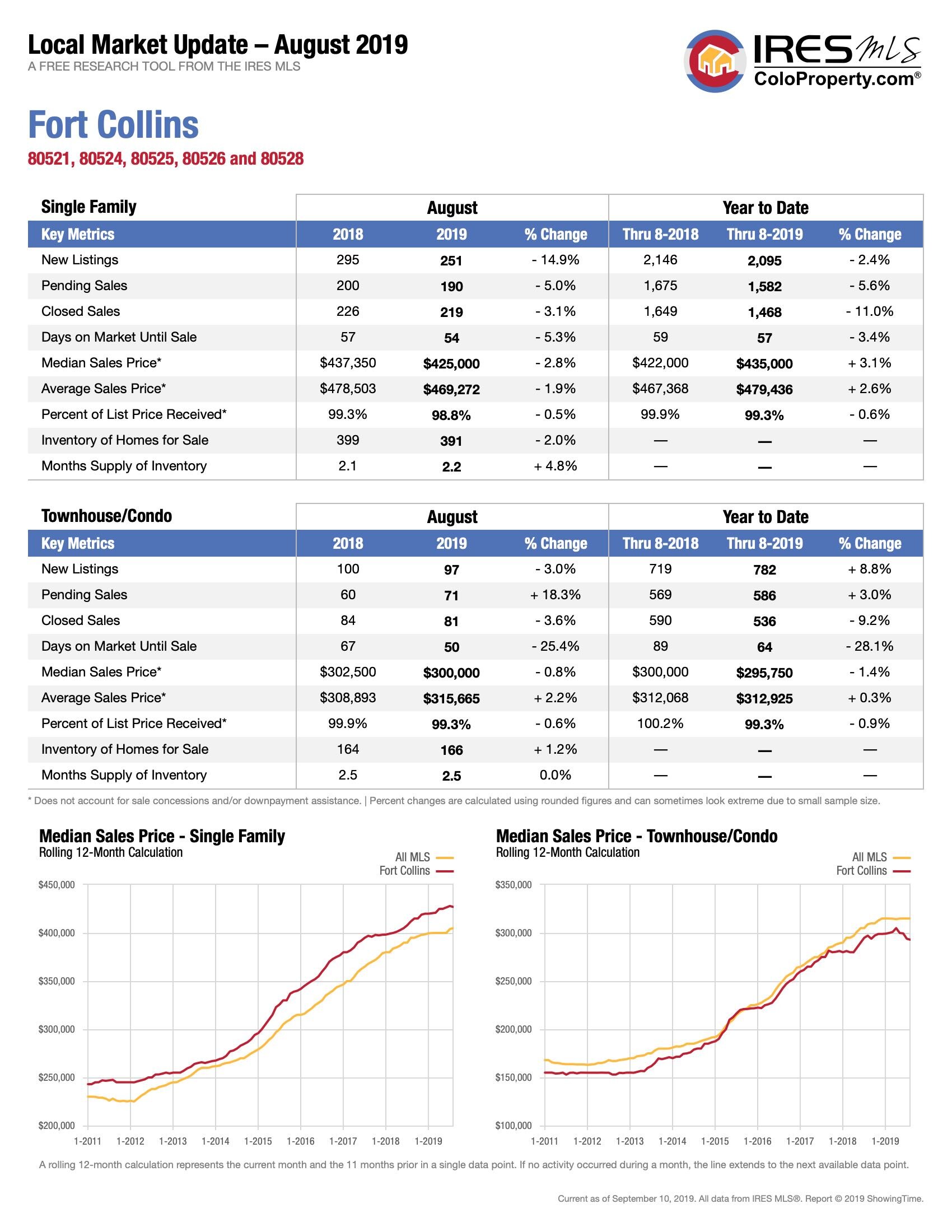

The 2019 Median Sales Price in Fort Collins is: $435,000.

Using a purchase price of $435,000, see how the example scenario below can affect buyers with just a 1% increase in interest rates…

Monthly Payment at 4%: $2,092.78

New Monthly Payment at 5%: $2,299.51

That’s $206.73 more a month!

The monthly payment example was based off a 30 year loan, 20% cash down and a rough estimate of property taxes. For buyers putting less than 20% down, PMI (Private Mortgage Insurance) would also need to be factored in.

Buying Power

Interest rates increasing by 1% can also reduces your “Buying Power” by 9%- 11%. That means if the top of your budget was $435,000 with a 4% interest rate, the new top of your budget would be reduced to $387,150 with a 5% interest rate!

These are pictures of real kitchens from homes for sale in Fort Collins.

If interest rates increase, will it cost you your dream home?

BUYERS

“I’ll wait until home prices go way down.”

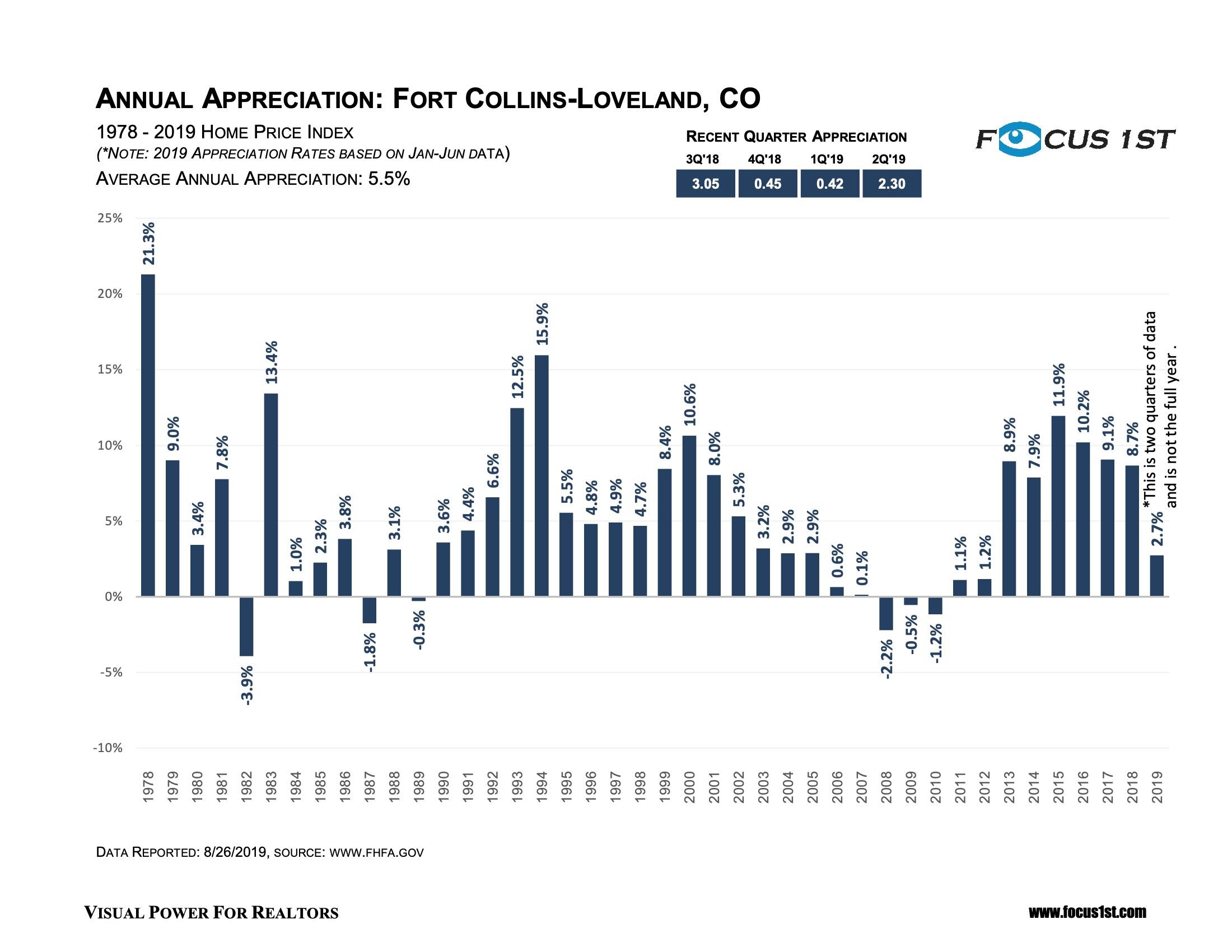

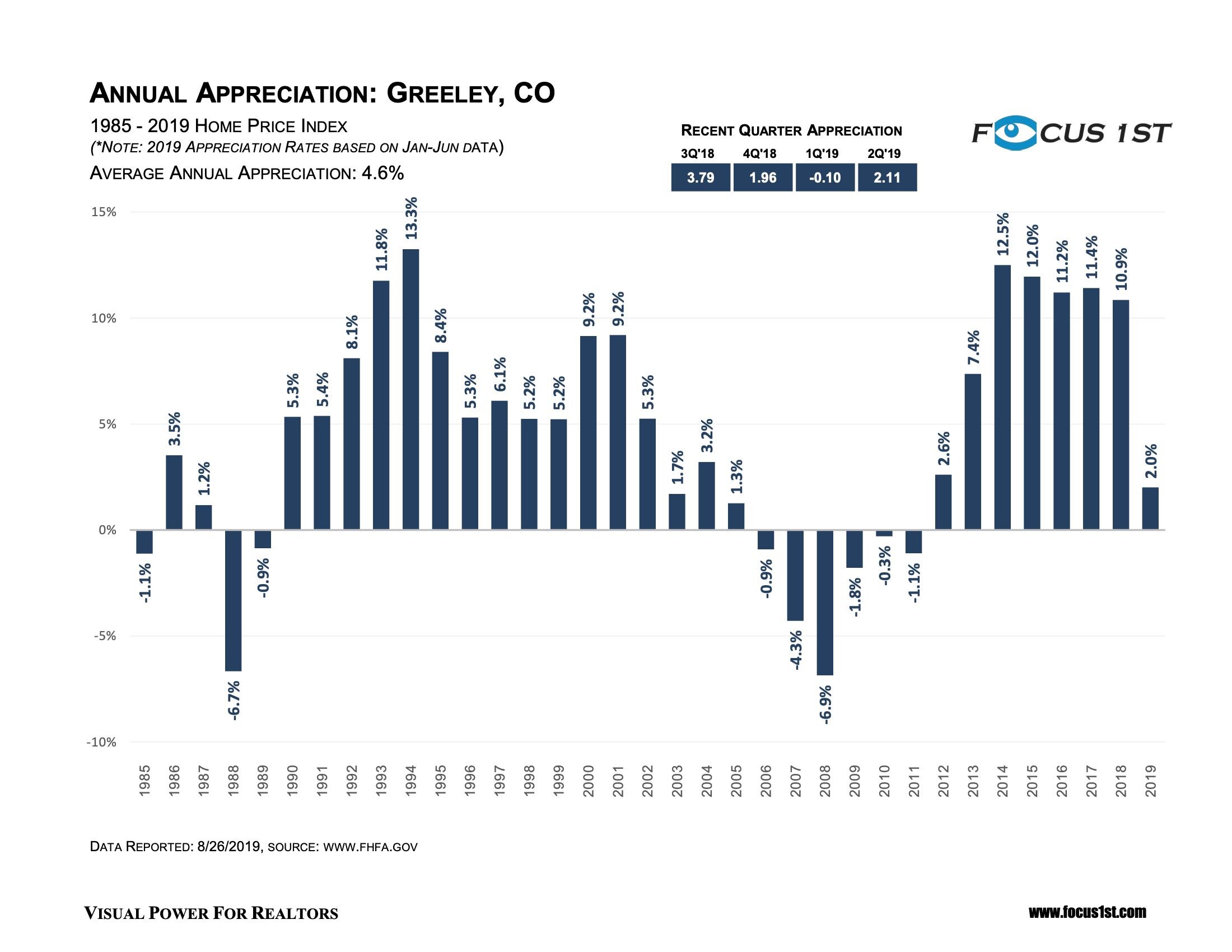

Home prices in Northern Colorado have never gone “way down” Click here to see the market appreciation in Fort Collins & Loveland since 1978. The biggest loss the Fort Collins/Loveland market has experienced in our lifetime was in 2008 and that was only 2.2%!!!

SELLERS

“I think I’ll wait until the summer market to sell”

Low interest rates mean more buyers are shopping. It also means that their “Buying Power” has increased which means more buyers can afford your house!

OPPORTUNITY IS KNOCKING

We are seeing incredible opportunities for buyers and sellers. For an individual analysis of your opportunities in this market, click here to schedule a phone appointment, listing walkthrough or buyer consultation with us!

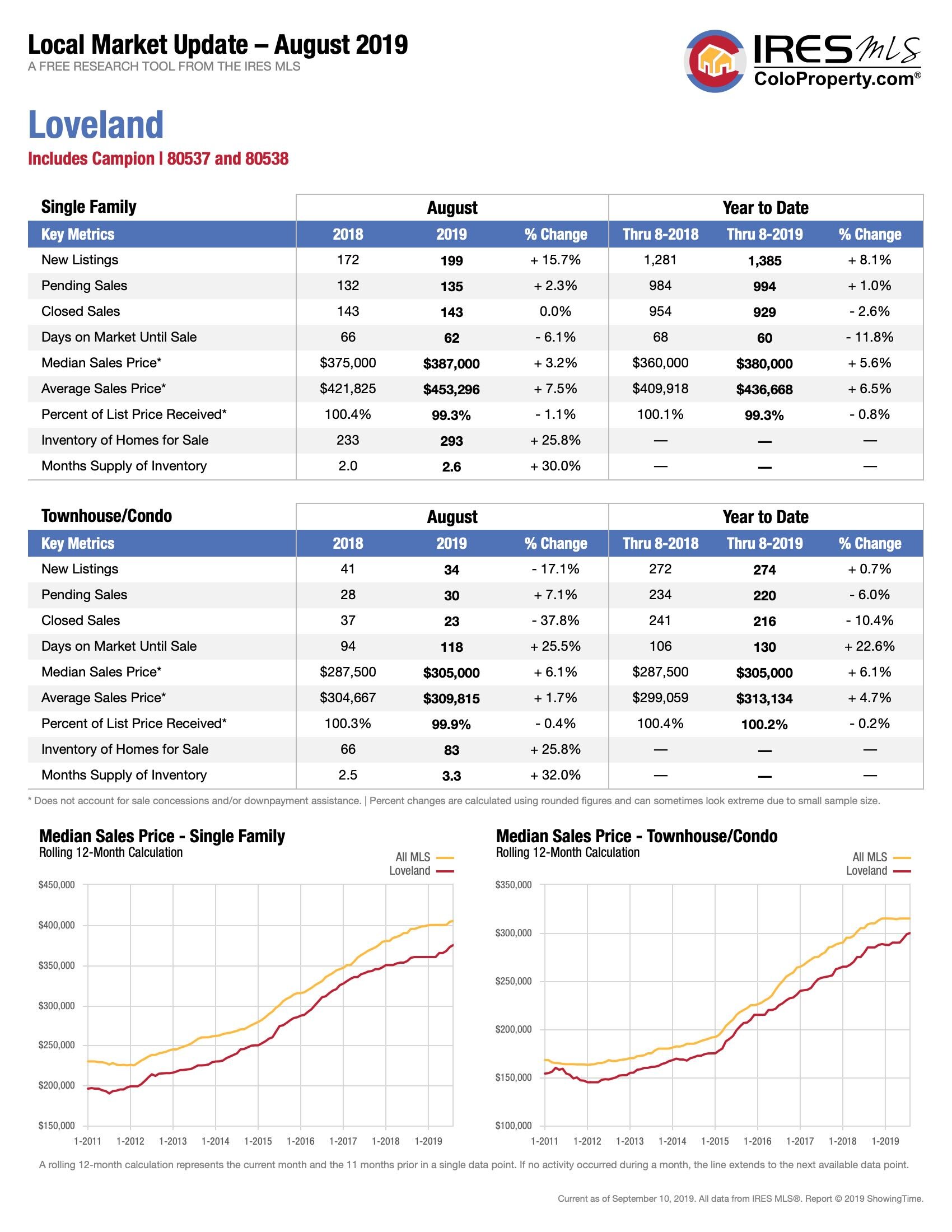

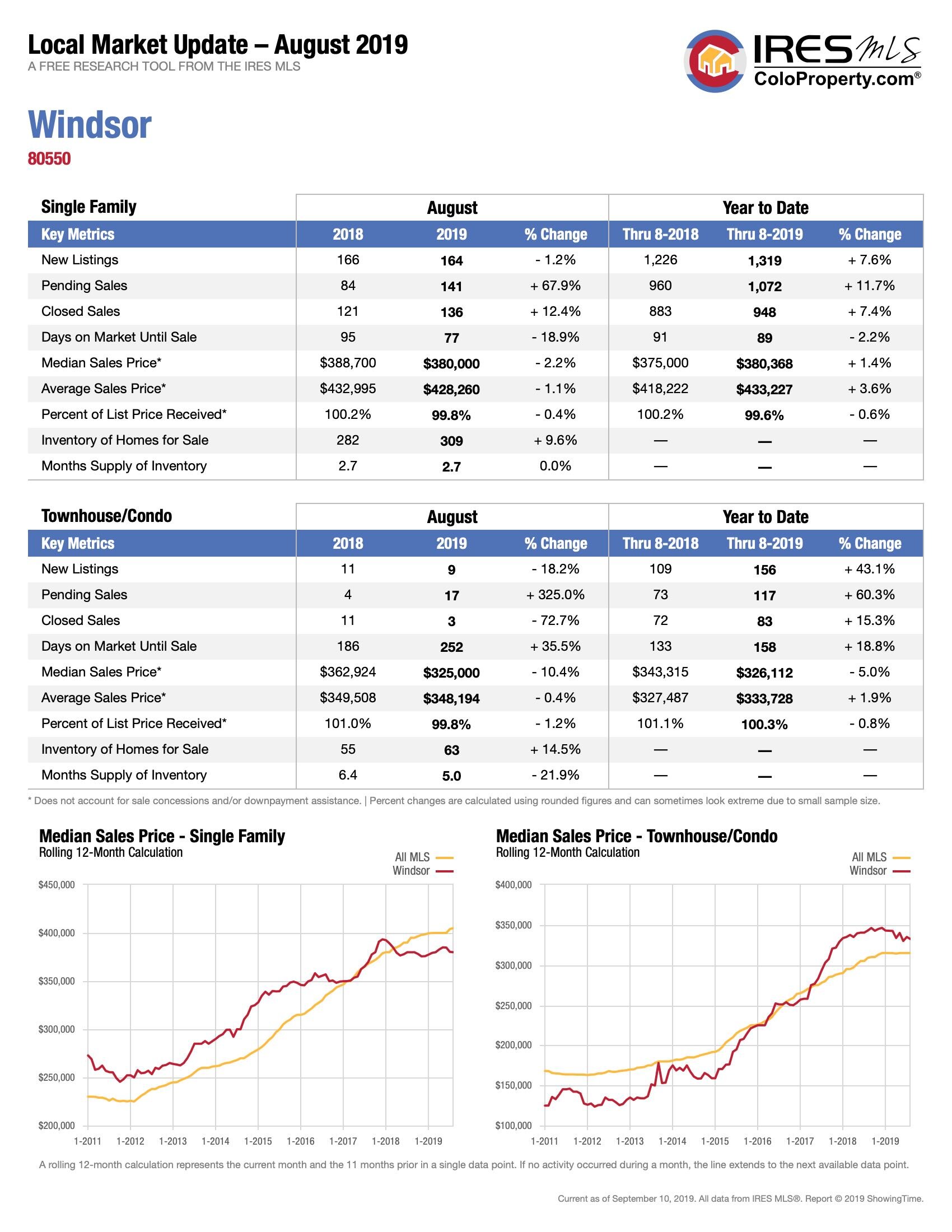

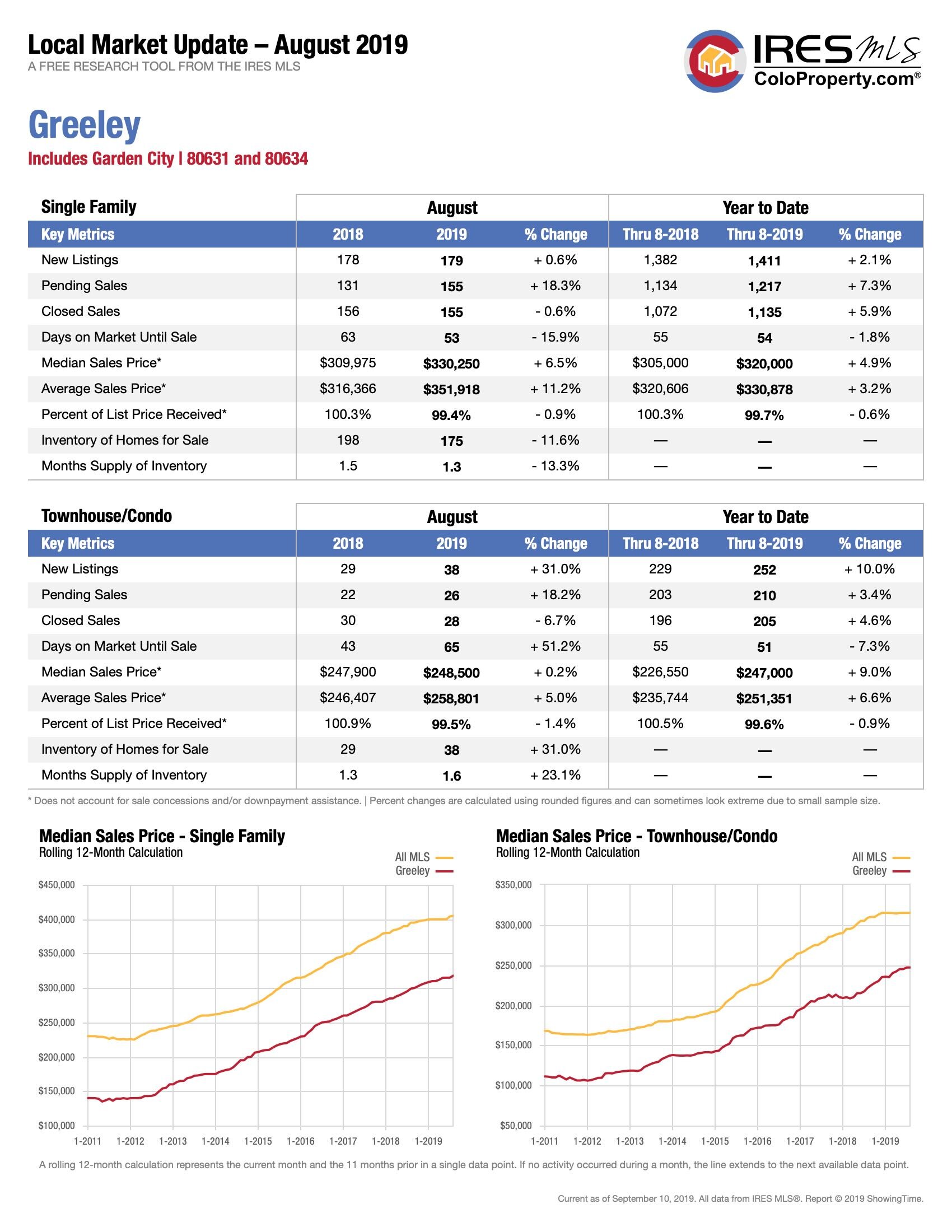

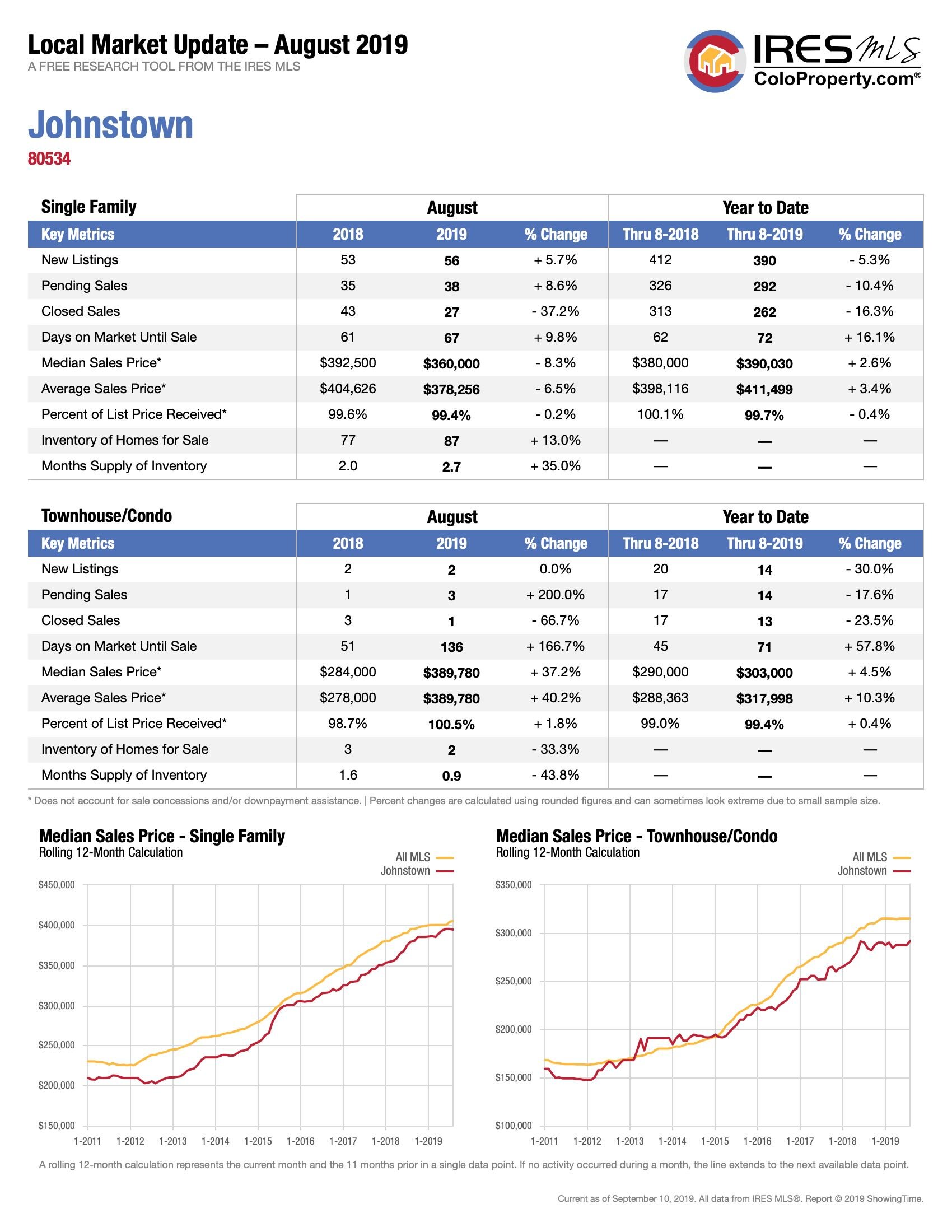

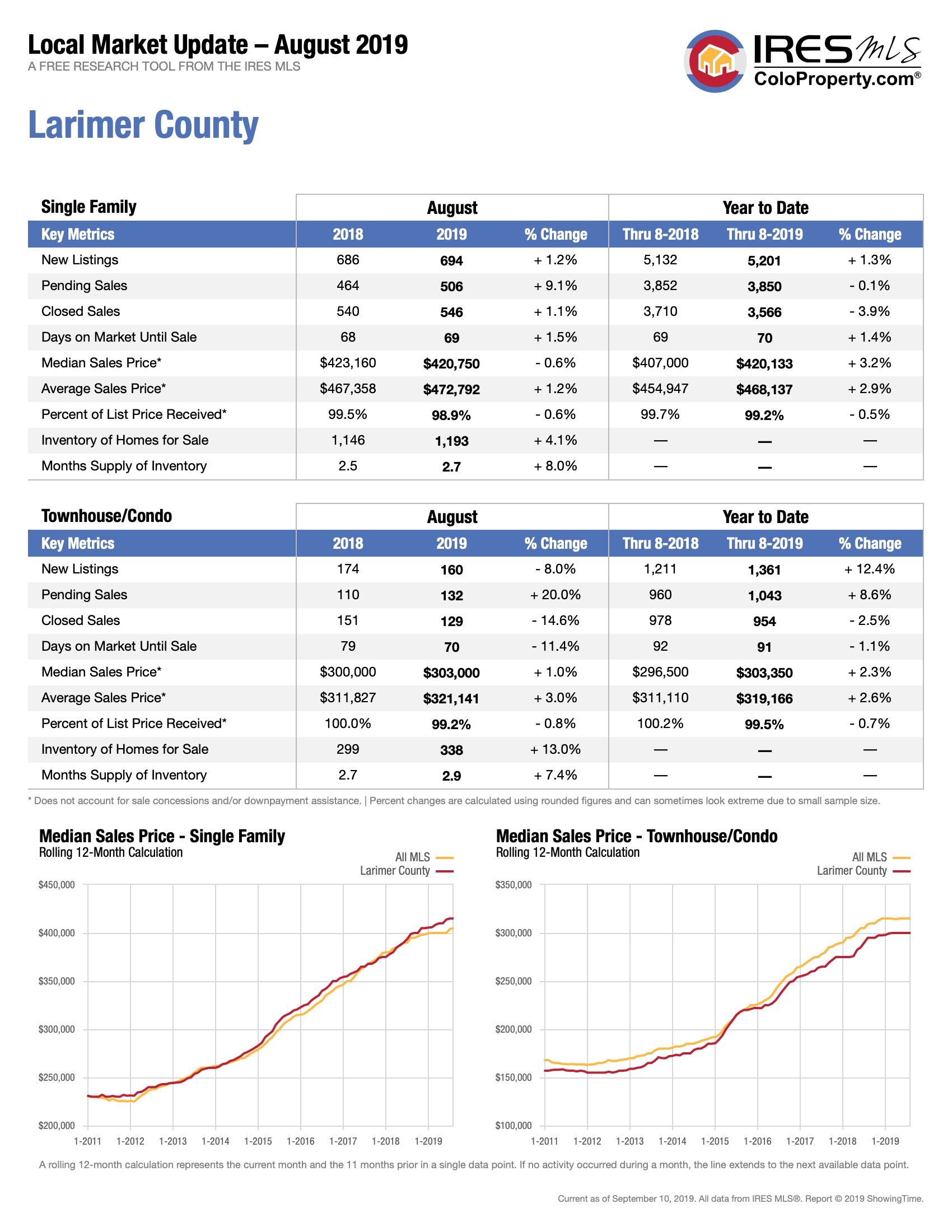

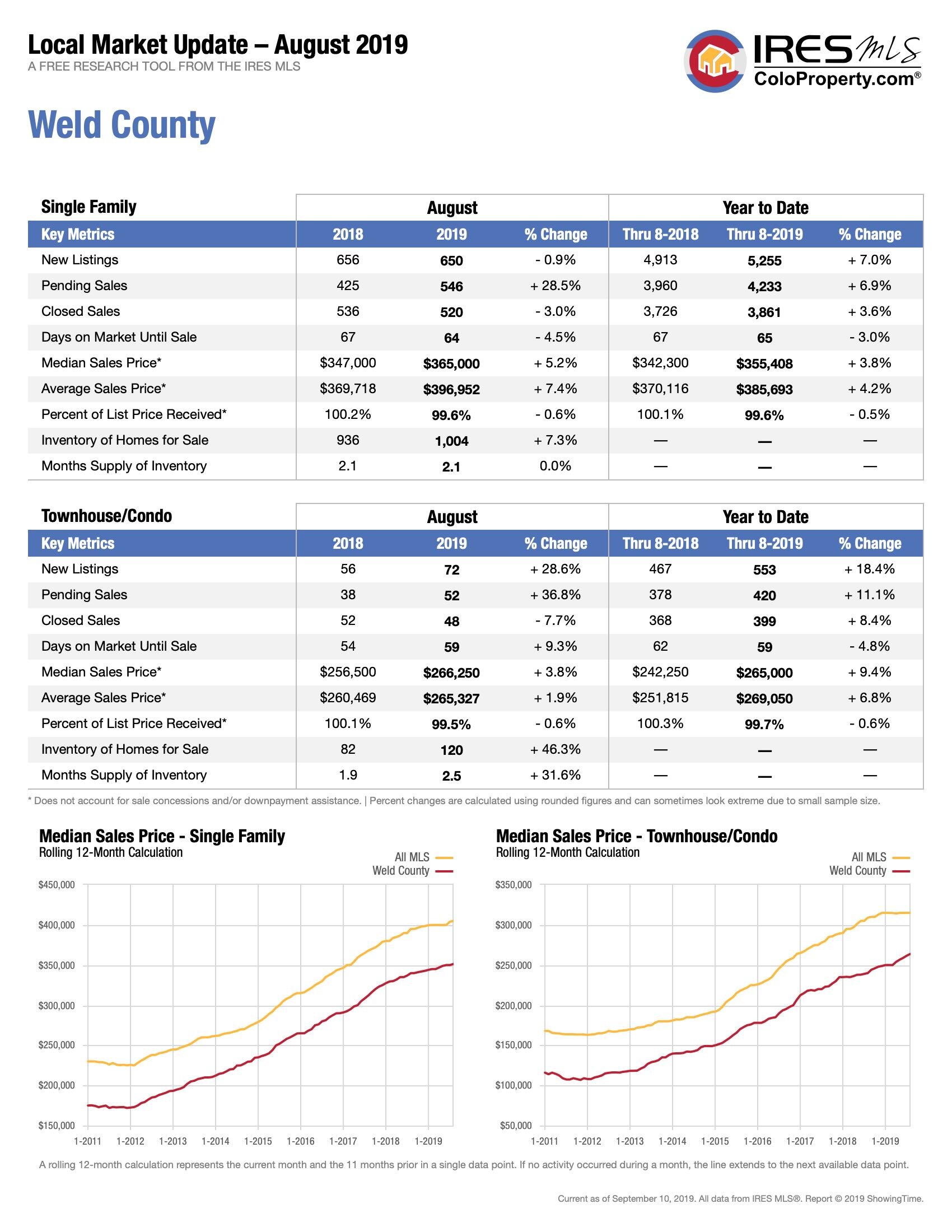

Market Data

For a FREE Pre-Qualification or Questions on Re-Financing, Call 970-999-2717

Molly Kincaid

Loan Officer

NMLS # 1414626

Mobile: (970) 999-2717

mkincaid@partnersunitedfinancial.com

Website